Fluctuation analysis accounting

Home » Query » Fluctuation analysis accountingYour Fluctuation analysis accounting images are available. Fluctuation analysis accounting are a topic that is being searched for and liked by netizens now. You can Get the Fluctuation analysis accounting files here. Download all free photos.

If you’re looking for fluctuation analysis accounting images information connected with to the fluctuation analysis accounting interest, you have visit the ideal blog. Our site always gives you hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

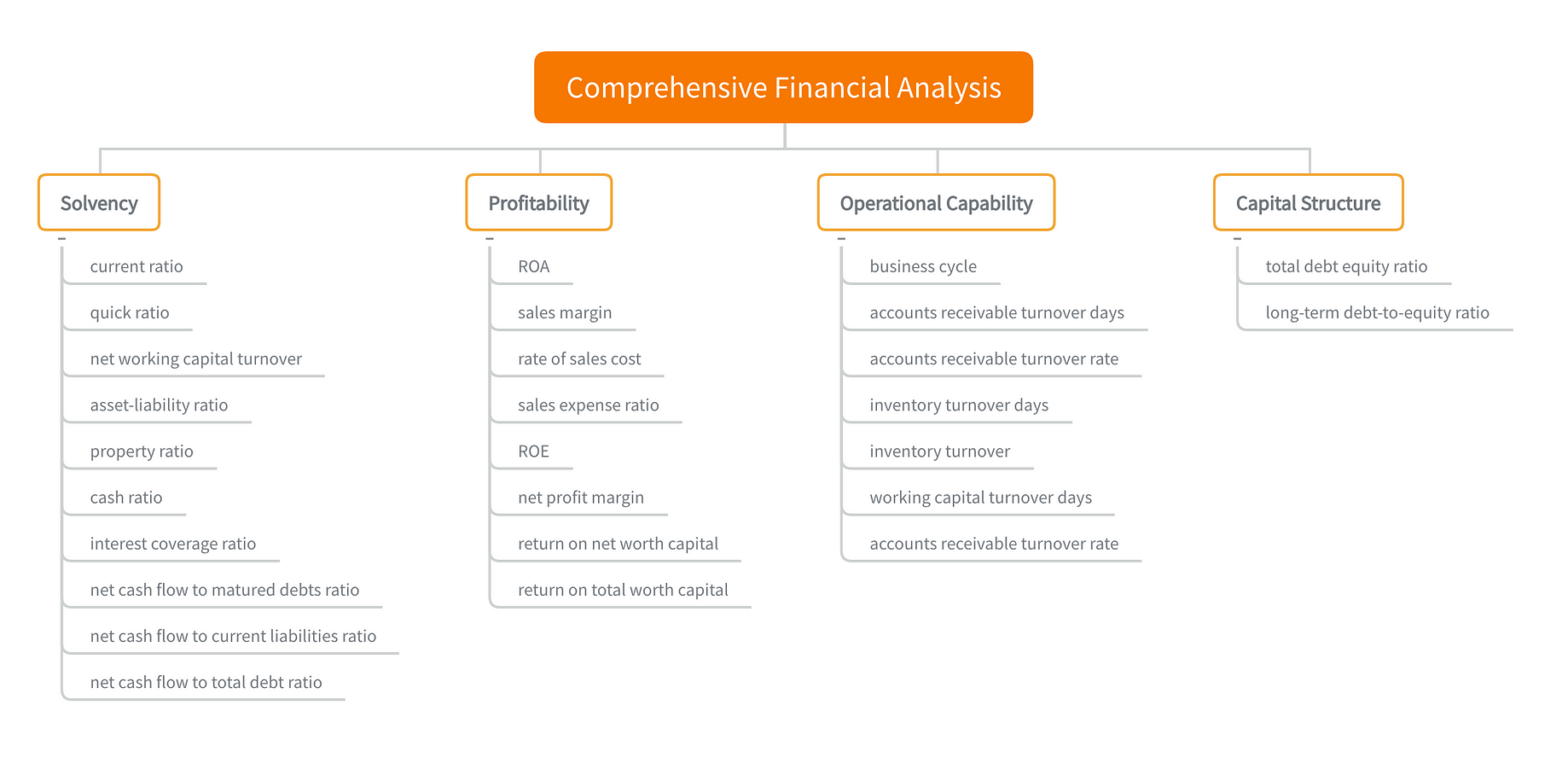

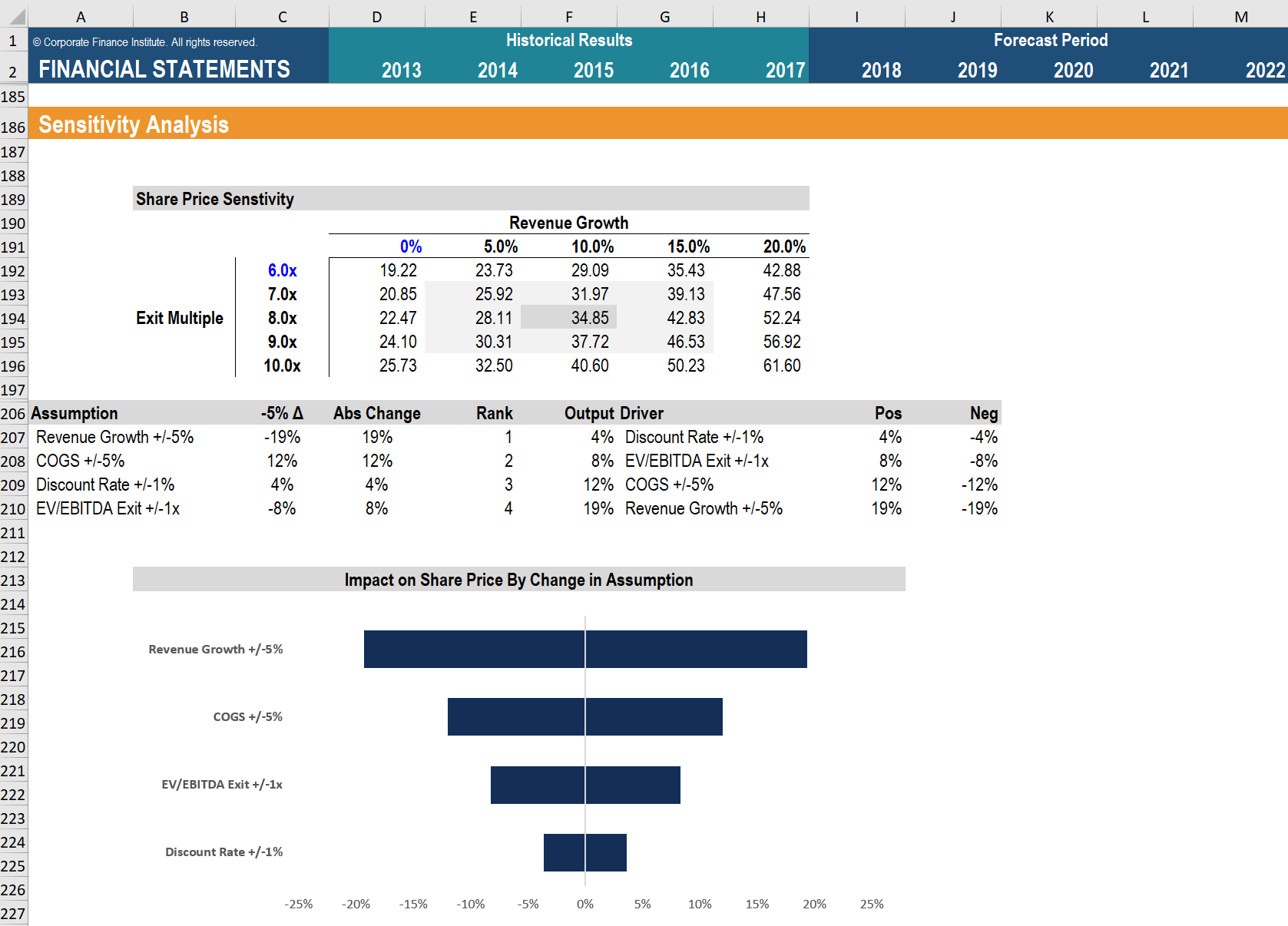

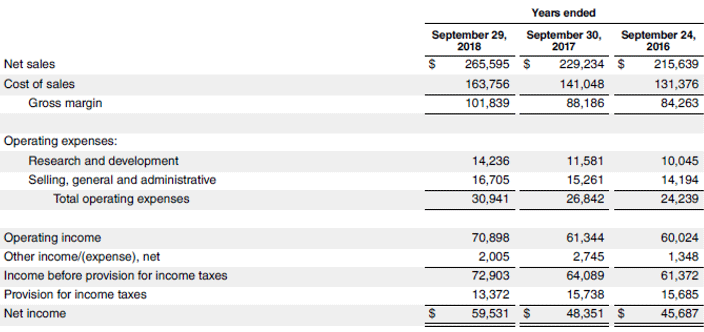

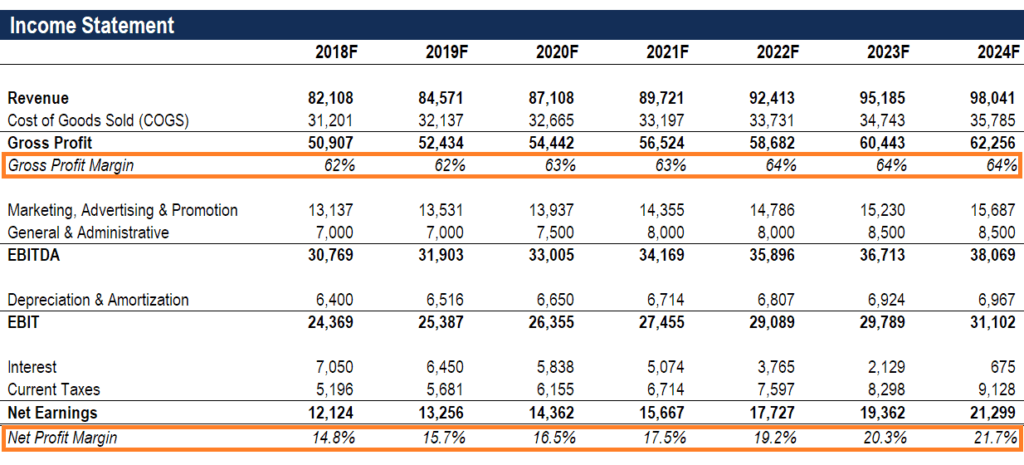

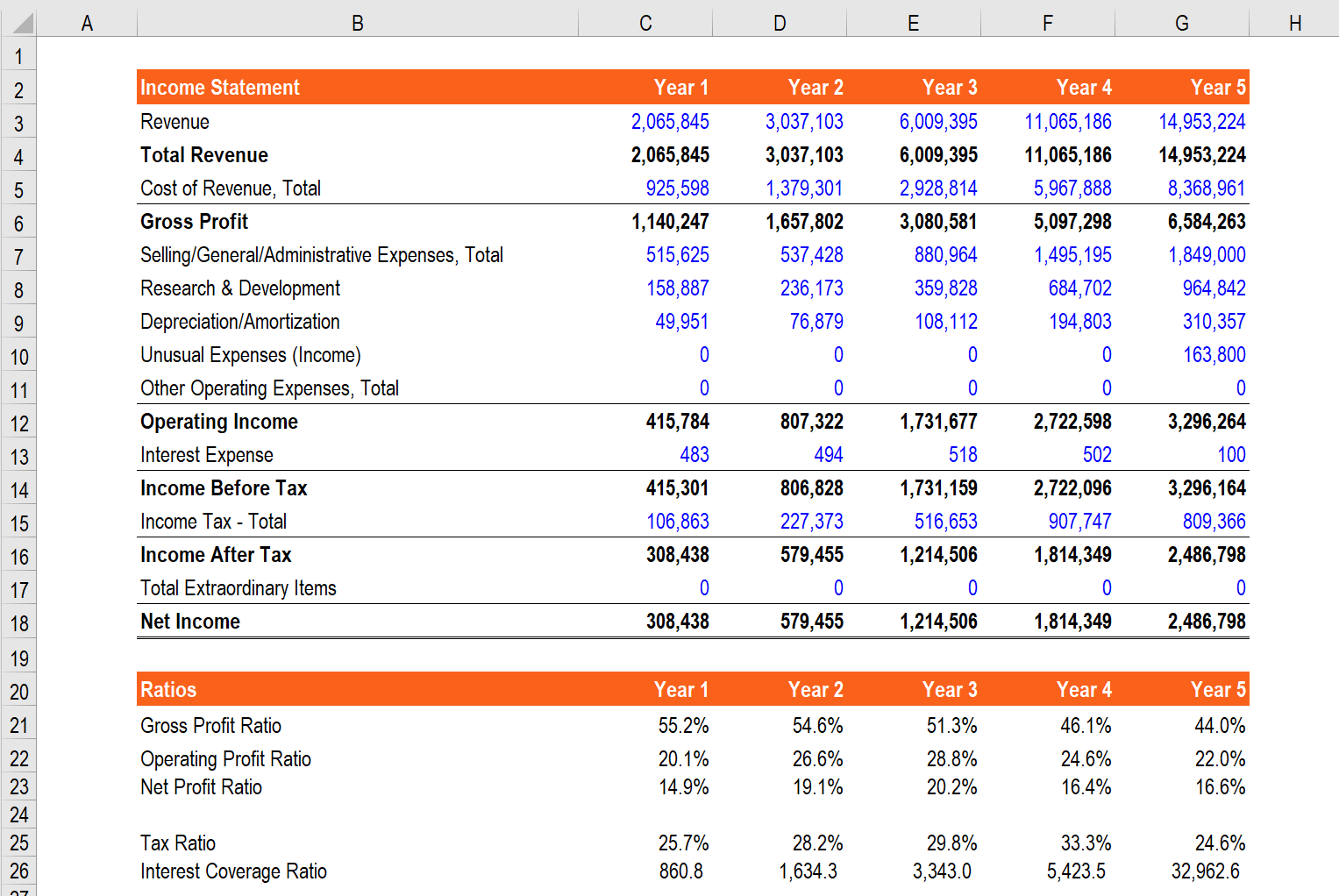

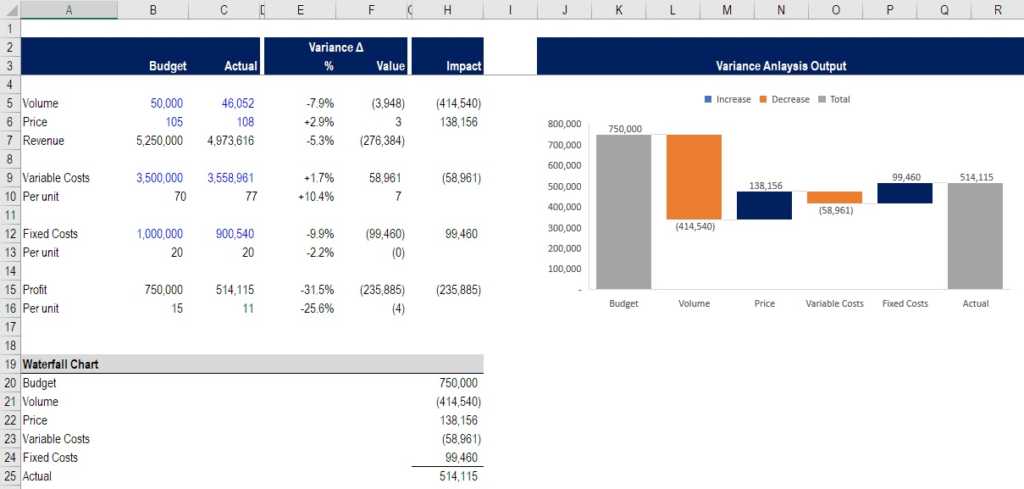

Fluctuation Analysis Accounting. The main task of an analyst is to perform an extensive analysis of financial statements Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. Once the analysis of the firm and its financial statements are completed there are further questions that must be answered. I am in public accounting and have been tasked with performing variance analysis on accounts that have significant fluctuations. Financial analysis is also critical in evaluating the relative stability of revenues and earnings the levels of operating and financial risk and the performance of management.

Financial Reporting Fluctuation Flux Analysis Ppt Video Online Download From slideplayer.com

Financial Reporting Fluctuation Flux Analysis Ppt Video Online Download From slideplayer.com

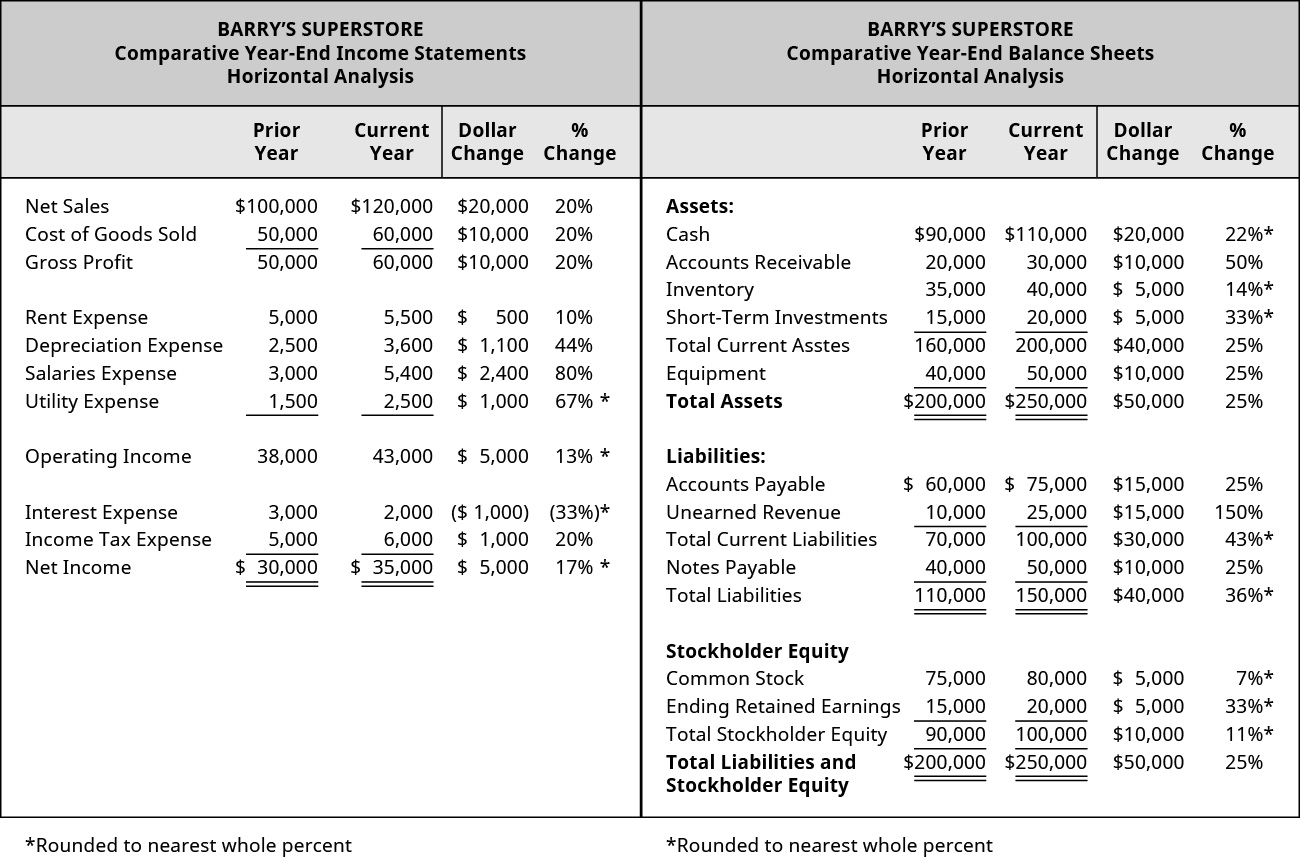

ACCOUNTING method of valuing INVENTORY under which the costs of the first goods acquired are the first costs charged to expense. The most common analysis I have seen are account reconciliations where every GL account balance sheet in particular is tied out to supporting information and period fluctuation analysis. Accountants use it to understand the changes in Income Statement and Balance Sheet accounts over two periods- could be month over month budget vs actual prior quarter vs current quarter etc. Profit and loss report often referred as PL report income statement or statement of operations is one of the primary reports in the system of enterprise accounting which plays an important role in the financial statement analysis. Financial statement analysis is one of the most important steps in gaining an understanding of the historical current and potential profitability of a company. This is not really necessarily a SOX-related question but I thought Id try asking here anyway since some of you might be ex external auditors.

This ratio analysis though should be considered the payment cycle of the entity and the seasonal fluctuation.

Consistent analysis of change provides decision-driving insight especially as flux data doesnt just function as a predictive force. A flux analysis is a powerful tool that analyzes fluctuations in account balances over time. Upon the close of. This ratio analysis though should be considered the payment cycle of the entity and the seasonal fluctuation. Financial statement analysis is one of the most important steps in gaining an understanding of the historical current and potential profitability of a company. In performing fluctuation analysis both dollar and percentage changes should be analyzed.

Source: investopedia.com

Source: investopedia.com

It is a complete analysis of items on the balance sheet at the various intervals of time like quarterly. A flux analysis is a powerful tool that analyzes fluctuations in account balances over time. Flux analysis means fluctuation analysis. The most common analysis I have seen are account reconciliations where every GL account balance sheet in particular is tied out to supporting information and period fluctuation analysis. Upon review and successful completion of all processes related to the period close HQ CFR and Accounting Services Eagan are advised.

Source: opentextbc.ca

Source: opentextbc.ca

The Outlays fluctuation analysis is based on the outlays line item on the Statement of Budgetary Resources which is populated by USSGL accounts 49X2 and 48X2 budgetary cash paid activities Does not compare to the USSGL account 6100 fluctuation analysis proprietary activities or the Obligations fluctuation analysis. Upon the close of. Guide to Financial Statement Analysis. This is not really necessarily a SOX-related question but I thought Id try asking here anyway since some of you might be ex external auditors. Accountants use it to understand the changes in Income Statement and Balance Sheet accounts over two periods- could be month over month budget vs actual prior quarter vs current quarter etc.

Source:

Commonly known as FIFO. Commonly known as FIFO. Accounting students can take help from Video lectures handouts helping materials assignments solution On-line Quizzes GDB Past Papers books and Solved. Can we really trust the numbers that are being provided There are many reported instances of accounting irregularities. This is not really necessarily a SOX-related question but I thought Id try asking here anyway since some of you might be ex external auditors.

Source: towardsdatascience.com

Source: towardsdatascience.com

Balance sheet analysis is the analysis of the assets liabilities and owners capital of the company by the different stakeholders for the purpose of getting the correct financial position of the business at a particular point in time. For example one can calculate a companys quick ratio to estimate its ability to pay its immediate liabilities or its debt to equity ratio to see if it has taken on too much debt. It contains summarized information about firms revenues and expenses over the reporting period. Profit and loss report often referred as PL report income statement or statement of operations is one of the primary reports in the system of enterprise accounting which plays an important role in the financial statement analysis. Upon review and successful completion of all processes related to the period close HQ CFR and Accounting Services Eagan are advised.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

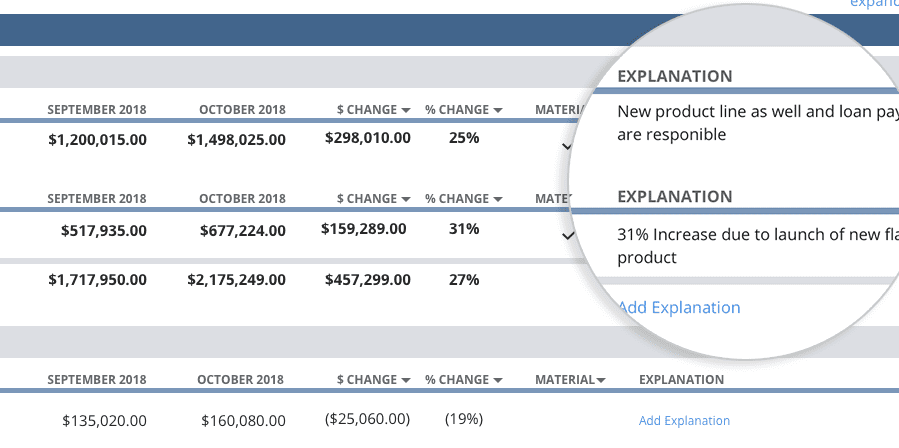

Continuously monitor for risk with automated fluctuation analysis BlackLine Variance Analysis automates the calculation and identification of account balance and activity fluctuations to enable continuous monitoring for risk ensure the effective and timely execution of critical management review controls and support agile decision making. This is not really necessarily a SOX-related question but I thought Id try asking here anyway since some of you might be ex external auditors. Guide to Financial Statement Analysis. Best practices I have seen are to involve business people in the review and approval of their numbers require them to take some ownership. ACCOUNTING method of valuing INVENTORY under which the costs of the first goods acquired are the first costs charged to expense.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

This ratio analysis though should be considered the payment cycle of the entity and the seasonal fluctuation. This also means that the stated balances of the related receivables and payables will reflect the current exchange rate as of each subsequent balance sheet date. Analysis of staff turnoverfluctuation Given the data collected over a period of four years for the analysis of staff turnoverfluctuation will be brought into discussion besides the frequencies and procentage expressions and calculation of indices for personnel flow using these formulas. One of the most critical is. What is the difference between depreciation and fluctuation.

Source:

Balance sheet analysis is the analysis of the assets liabilities and owners capital of the company by the different stakeholders for the purpose of getting the correct financial position of the business at a particular point in time. 9 Flux analysis involves aggregating data from multiple periods and identifying material fluctuations from period to. This ratio analysis though should be considered the payment cycle of the entity and the seasonal fluctuation. In performing fluctuation analysis both dollar and percentage changes should be analyzed. It contains summarized information about firms revenues and expenses over the reporting period.

Source: educba.com

Source: educba.com

For example- if the payment cycle is in progress the cash with the entity would obviously be low thereby not giving the correct picture of the financial situation. In performing fluctuation analysis both dollar and percentage changes should be analyzed. Flux analysis means fluctuation analysis. I am in public accounting and have been tasked with performing variance analysis on accounts that have significant fluctuations. This is not really necessarily a SOX-related question but I thought Id try asking here anyway since some of you might be ex external auditors.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Fluctuation analysis is performed on balance sheet accounts prior to close to validate reasonableness. Balance sheet analysis is the analysis of the assets liabilities and owners capital of the company by the different stakeholders for the purpose of getting the correct financial position of the business at a particular point in time. These three core statements areIn this free guide we will break down the most important methods types and approaches to financial. Best practices I have seen are to involve business people in the review and approval of their numbers require them to take some ownership. Period of 12 consecutive months chosen by an entity as its ACCOUNTING period which may or may not be a.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

Upon review and successful completion of all processes related to the period close HQ CFR and Accounting Services Eagan are advised. The main task of an analyst is to perform an extensive analysis of financial statements Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. This also means that the stated balances of the related receivables and payables will reflect the current exchange rate as of each subsequent balance sheet date. A flux analysis is a powerful tool that analyzes fluctuations in account balances over time. Fluctuation analysis is performed on balance sheet accounts prior to close to validate reasonableness.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Period of 12 consecutive months chosen by an entity as its ACCOUNTING period which may or may not be a. It contains summarized information about firms revenues and expenses over the reporting period. The most common analysis I have seen are account reconciliations where every GL account balance sheet in particular is tied out to supporting information and period fluctuation analysis. A flux analysis assists with forecasting budgeting and maintaining corporate integrity. This ratio analysis though should be considered the payment cycle of the entity and the seasonal fluctuation.

Source: slideplayer.com

Source: slideplayer.com

One of the most critical is. These three core statements areIn this free guide we will break down the most important methods types and approaches to financial. I am in public accounting and have been tasked with performing variance analysis on accounts that have significant fluctuations. Can we really trust the numbers that are being provided There are many reported instances of accounting irregularities. This ratio analysis though should be considered the payment cycle of the entity and the seasonal fluctuation.

Source: towardsdatascience.com

Source: towardsdatascience.com

It contains summarized information about firms revenues and expenses over the reporting period. Commonly known as FIFO. I am in public accounting and have been tasked with performing variance analysis on accounts that have significant fluctuations. Upon review and successful completion of all processes related to the period close HQ CFR and Accounting Services Eagan are advised. For example- if the payment cycle is in progress the cash with the entity would obviously be low thereby not giving the correct picture of the financial situation.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

This also means that the stated balances of the related receivables and payables will reflect the current exchange rate as of each subsequent balance sheet date. ACCOUNTING method of valuing INVENTORY under which the costs of the first goods acquired are the first costs charged to expense. Fluctuation analysis In addition to reconciliations and adjustments accounting teams track the health of the company by conducting fluctuation analysis flux analysis. Accounting students can take help from Video lectures handouts helping materials assignments solution On-line Quizzes GDB Past Papers books and Solved. Can we really trust the numbers that are being provided There are many reported instances of accounting irregularities.

Source: journalofaccountancy.com

Source: journalofaccountancy.com

It is a complete analysis of items on the balance sheet at the various intervals of time like quarterly. Financial analysis is also critical in evaluating the relative stability of revenues and earnings the levels of operating and financial risk and the performance of management. Commonly known as FIFO. This can result in the recognition of a series of gains or losses over a number of accounting periods if the settlement date of a transaction is sufficiently far in the future. Fluctuation analysis is the most basic form of financial statement analysis and simply involves review of changes in the balance sheet income statement and other balances from period to period.

Source: floqast.com

Source: floqast.com

Period of 12 consecutive months chosen by an entity as its ACCOUNTING period which may or may not be a. Fluctuation analysis In addition to reconciliations and adjustments accounting teams track the health of the company by conducting fluctuation analysis flux analysis. Best practices I have seen are to involve business people in the review and approval of their numbers require them to take some ownership. Once the analysis of the firm and its financial statements are completed there are further questions that must be answered. This also means that the stated balances of the related receivables and payables will reflect the current exchange rate as of each subsequent balance sheet date.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Financial analysis is also critical in evaluating the relative stability of revenues and earnings the levels of operating and financial risk and the performance of management. The main task of an analyst is to perform an extensive analysis of financial statements Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. One of the most critical is. Best practices I have seen are to involve business people in the review and approval of their numbers require them to take some ownership. Period of 12 consecutive months chosen by an entity as its ACCOUNTING period which may or may not be a.

Source: opentextbc.ca

Source: opentextbc.ca

One of the most critical is. Upon the close of. Flux analysis means fluctuation analysis. The Outlays fluctuation analysis is based on the outlays line item on the Statement of Budgetary Resources which is populated by USSGL accounts 49X2 and 48X2 budgetary cash paid activities Does not compare to the USSGL account 6100 fluctuation analysis proprietary activities or the Obligations fluctuation analysis. ACCOUNTING method of valuing INVENTORY under which the costs of the first goods acquired are the first costs charged to expense.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fluctuation analysis accounting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.